This contribution addresses

and reviews current and progressing CRM supply trends and needs, potential mineral

resources targets invented, and related key value chain developments with the

EU industry in focus, by mainly looking for answers to the following questions.

- Why and how a European CRM list?

- What is the current state and what needs to be done in the fields of CRM Economic Geology and related value chains?

- Bottlenecks that today make CRM industry perspective and future difficult to be predicted and any foresight studies undertaken becoming uncertain; the example of cobalt

- Which are then the risks, impacts and consequences that might be emerged and which could be the solutions?

Current CRM

list

Critical

Raw Materials are both of high economic importance for the EU and vulnerable to supply

disruption. These limitations and conditions became the major elements of the

methodology applied to provide the 2017 criticality assessment, with the 26 raw

materials shown below, excluding lithium.

European mineral raw

material challenges

The mining sector and

the mineral processing sector are vital to securing the supply of metals

extracted in a sustainable manner to be used in high-tech value chains and to

address challenges considering that,

- The mineral value chain spans from geological exploration, mining and

processing to the recycling of metals.

- There is a strong environmental commitment both during operation, as well as for the reclamation of land used for mining, embedded in value chain.

- The transition to a low-carbon, fossil-free sustainable Europe and the green economy is a prime societal challenge.

- The electric infrastructure as well as energy storage systems, renewable

energy power plants and vehicles have a tight implementation agenda.

- Fossil-free aggregate production to build new transport infrastructure as well as new green buildings has a central role

Strategic

mineral-based value chains for the EU

The EU, and apparently

the rest of the world, is challenging a growing

demand for mineral raw materials stemming mainly from the emerging

digital revolution, the innovation to e-mobility and artificial intelligence

technologies, and the transition towards a low-carbon and low-waste future.

This development is triggering and enabling reshaped or new value chains of mineral raw materials industries from the

upstream to the downstream, e.g. from exploration, mining, processing

and products along the value chain to end-use manufacturing. The intensity on

the economy and society, in securing the increasing resources potential and

supply needed, will continue remaining notably high, particularly in the case of critical raw materials which

by almost 60% are related to high-growth enterprising.

The six identified strategic mineral-based value chains require sustainable

supply of certain raw materials, beyond only the critical ones.

- Renewable energy –Wind & PV value chain: Al, Cu, Pb, Nd, Pr, Dy,

B, Mn, Ni, Cr, Fe, Mo, Nb, Ag, Zn, Ga, Se, Te, Cd, In, Si,

Sn

- Grids value chain: Cu, Al, Ni, Fe, Si

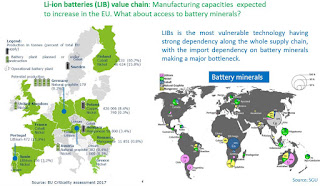

- Li-ion batteries (LIB) value chain*: Ni, Co, Cu, Li, Al, Mn, V, C-graphite

- Electric vehicles (EVs) value chain*: Ni, Co, Cu, Li, Al, Mn, C-graphite, Fe, Cr, Mo, V, Si,

Mg, B, Nd, Pr, Dy

- Robotics value chain: Fe, Al, Cr, Co, Mo,

Si, C-graphite, Ti, Ni, Mg, V, Cu, Pb, Ag, Sn, Sb, Bi, Au, Mn, Zn, REE, Li

- Defense value chain: Al, Cu, Pb, Nb, W, Ba,

Ga, Li, Rh, V, Be, Ge, Mg, Ta, Zn, Cd, Hf, Mn, Zr, Cr, In,

Mo, Sn, Co, Fe, Ni, Ti, Dy, Nd, Pr, Sm, Yb, Au, Pt, Ag, B,

Se

Considering the value chains and related raw materials it is found out

that,

- China delivers around half of the raw materials required for all six strategic value chains.

- China keeps its leading position across all domains (extraction, processing, refining) of CRM value chains.

- Europe is less dependent further down the industrial value chains.

- Europe is vulnerable to supply of RM for all mentioned value chain technologies/sectors.

- LIB is the most vulnerable technology: strong dependency along the whole supply chain.

- Higher resilience of Europe downstream the supply chain, for example processed materials.

- Best case for Grids, as Europe is self-sufficient on the raw materials needed.

- The renewable energy, Li-batteries and electric vehicles value chains are closely related and interlinked, having a crucial role in implementing the Paris declaration and the SDGs, as well as to address a low-carbon and green economy future.

Electrification

and artificial intelligence

It is evident

that electrification and artificial intelligence make top priorities of EU’s

industrial strategy and related sustainable development, with respect to mainly

SDGs and climate change agenda. Raw materials and advanced materials are the

key enablers for the transition in the energy and mobility sectors. Since

electrification is the basis for the transition from brown to green economy to

happen, there will be enormous amounts of electricity needed to be produced, of

course, from renewable sources. Having all this in mind and in relation to all

outlooks showing a strongly growing demand for energy and increasing

requirements for responsible mining, two more value chains seem to be strategic

targets,

·

Renewable energy –Wind & Photovoltaics (PV) value chain, and

· Robotics value chain

The example

of cobalt

Although any kind of forecasting is uncertain all scenarios indicate that

cobalt demand for Li-battery manufacturing will exceed the supply until 2030,

given the total number of more than 110 million electric cars expected to be

produced by then. This anticipates also an exponential growth in the demand for

other battery raw materials like nickel, aluminium, copper, graphite, lithium

and manganese minerals. Under average conditions around 64.000 tonnes of

additional cobalt will be needed to cover global demand in 2030. By then

internal EU supply can meet only 15% of European demand in the electric vehicle

sector, this way leading to a growing gap between internal supply and demand. In

the case of graphite, the demand will grow from 5.700 tonnes today to 157.400

tonnes by 2030. It is obvious that

mineral raw materials availability and stable supply is strongly influencing

and determining the large-scale deployment of EVs. Of course, cobalt

availability may be available but most probably at the expense of increased

prices for battery manufacturers and continued dependence on unethical supplies

from Democratic Republic of Congo (DRC). To avoid it future mobility would have

to rely on cobalt extracted within the EU by opening of new mines and

recovering it through recycling.

Economic

geology of European CRM and battery minerals

The problem

seems not to be the CRM Geology approach at EU level although this will also

need to take some time developing the Economic Geology models and achieve

credible resource potential estimates and exploitation schemes.

Securing raw

materials supply sustainability, further surveys and exploration need to be

conducted on two challenging resource potential targets indigenous to the EU.

PRIMARY RESOURCES

The main

challenges for sustainable supply of primary CRM in Europe are:

- Development of innovative technologies addressing exploration of CRM to discover new potential deposits on land and off shore.

- Development of new primary CRM production in Europe will decrease import dependence and make sure that exploitation takes place under sustainable conditions. This includes the necessity for exploration of deep-seated deposits in brownfield areas across the EU where potential CRM resources may occur in genetic associations with common industrial and other high-tech metals.

- Adapting technology, economical constraints and mind-set to allow for the exploitation of smaller and lower-grade deposits.

- Mining technologies adapted to the treatment of primary mineral resources with increasing complexity and decreasing grade.

- To refine low grade ores and materials containing CRM while reducing energy consumption and environmental impact.

- The need to develop methods for extracting all valuable metals from currently-mined ores and recycled materials, including minor elements that are commonly now rejected.

- Development of the technologies adjusted to the properties of the processed CRMs to increase

- extraction efficiency and metal recoveries

MINERAL-BASED

WASTES

The main

challenges related to supply of secondary CRM from mineral-based wastes, e.g.

mining waste,

processing tailings, in Europe are:

- Insufficient information about CRM compositions and volume characteristics in the mineral resources from primary ore deposits.

- Insufficient information about CRM compositions and volumes in mineral based wastes like for example mining waste such as dumps and tailings.

- Insufficient knowledge about mineralogical and geochemical behavior of CRM during mining and processing using physical and chemical methods.

- Insufficient information about the mineral-based character of residues, and their physical and chemical properties.

- Insufficient information about overall availability and resource potential of historic mining sites.

- Insufficient information about historical smelter locations and metallurgical wastes.

- High losses of CRM during pre-processing, impurities degrading product/residue quality.

- Lack of systematic identification/mapping of mining waste sites for future CRM extraction.

- Lack of a unified system for resource classification of CRM (e.g. UNECE/UNCF system) in various types of mining waste.

- Lack of specific methods of extracting metals and other valuable products from secondary, often heterogeneous sources.

- Overall lack of a full inventory and range of metals to anticipate future demand.

Potential

challenges, opportunities, risks and barriers

- The problem seems not to be the CRM Geology approach at EU level although this will also need to take some time developing the Economic Geology models and achieve credible resource potential estimates and exploitation schemes.

- Recycling and substitution are not now reliable CRM resource providers. In a way, recycling is a target but not a solution

- Dubious, lame, limping and failing progress of CRM value chains, and lack of balance between upstream-downstream efforts e.g. electric vehicles boom when energy transition and battery mineral resources are yet not secured.

- Car-makers are keener to increase their production and sales in EVs and forget to pay proper attention to issues concerning the CRM supply needed.

- Increased regulation vs Regulatory risk: Need for innovative policy instruments that are beneficial to all parties and work constructive rather than contradictory.

- Considering the long period of time (from exploration to mining takes about 15 years) needed for the CRM value chains to be fully operational, the technologies addressing the implementation plan of climate change goals might not always readily available due to lack of the mineral resources needed.

- Determined authorisation, decision-making and permitting procedure for a sustainable CRM EU-based industry is necessary if stakeholders are really interested and committed to develop and use climate-smart technologies, and to make the energy transition happen.

- The Social License to Operate concept or principle makes at present an old approach, needs to be left behind and should be replaced by currently sound societal challenges, such as the low-carbon and low-waste future.

- Ethics will have an impact on resource and supply issues related to some raw materials, such as Co, Nb, Ta.

- Financial uncertainties e.g rising costs, digital effectiveness, artificial intelligence, energy.

- China will continue controlling and driving mineral geopolitics in relation to high-tech value chains.

The way

forward

- Raw Materials from European primary and secondary resources are ideally suitable for establishing a system of responsible sourcing: raw materials produced in Europe can be taken as a guarantee for high standards in social, environmental and economic terms.

- Further surveys and exploration need to be conducted on primary and secondary resource potential targets indigenous to the EU.

- Criticality in the future also needs to include the issue of “responsible production and consumption” according to the SDG 12 goal.

- Elements and practices related to circular economy, responsible sourcing and resource efficiency addressed by the new EU industrial strategy, should be particularly considered

- Major European mineral belts, such as Fennoscandian, Iberian, Carpathian-Balkan, host highly potential exploration targets challenging the likelihood for discovery of new resources and feasible mining prospects.

- Europe’s opportunity to become self-sufficient and sustainable in mineral raw materials supply from own sources and resources, is strongly favored by its geological setting and metallogenetic evolution.

- For the EU to secure and maintain a full operational capability and capacity of the value chains mentioned above access to land is fundamental, making sure that responsible and innovative land stewardship throughout the mining life cycle is considered.

- Sustainable land- use related value chains integrates and maximises the multiple benefits related to economic, social, environmental and cultural values.

- The value chain approach enhances the steering capacity for the preparation and implementation of sustainable land-use plans addressing minerals development.

- Looking for optimisation of future balances between supply and demand.

Sources,

links and references

- https://ec.europa.eu/jrc/en/publication/eur-scientific-and-technical-research-reports/cobalt-demand-supply-balances-transition-electric-mobility

- http://iapgeoethics.blogspot.com/2019/01/circular-economy-is-about-resource.html

- https://ec.europa.eu/growth/sectors/raw-materials/specific-interest/critical_en

- Alves Dias P., Blagoeva D., Pavel C., Arvanitidis N., 2018: Cobalt: demand-supply balances in the transition to electric mobility. JRC Science for Policy Report, European Commission.

- Blagoeva D., Pavel C., Alves Dias P., 2018: Critical raw materials in strategic value chains. JRC Petten, Raw Materials Week, 2018.